|

|

|

|

|

|

|

|

|

|

Debet cards

|

Local cards

|

Credit cards

|

For business

|

Virtual cards

|

Security Requirements

|

|

Cash loans

|

Kredit kartlar

|

İPOTEKA KREDİTLƏRİ

|

Business loans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amount of insurance |

| Minimum sum |

| 1 year service fee |

| 2 years service fee |

| 3 years service fee |

| Currency |

| Advantage |

Mastercard Gold |

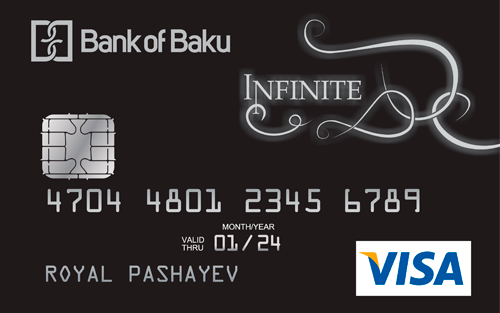

Visa infinite |

Visa Gold |

Visa Classic |

Visa Electron |

Mastercard Standard |

Maestro |

|---|---|---|---|---|---|---|

| Not considered. Note: For non-resident customers: 2000AZN/USD/EUR | Not considered. Note: For non-resident customers: 3000AZN/USD/EUR | Not considered. Note: For non-resident customers: 2000AZN/USD/EUR | Not considered. Note: For non-resident customers: 1000AZN/USD/EUR | Not considered. Note: For non-resident customers: 1000AZN/USD/EUR | Not considered. Note: For non-resident customers: 1000AZN/USD/EUR | Not considered. Note: For non-resident customers: 1000AZN/USD/EUR |

| Not applicable | Not applicable | Not applicable | Not applicable | Not applicable | Not applicable | Not applicable |

| 20 AZN - Notes: - No commission is charged where the minimum amount of the deposit into the account is 2000 AZN/USD/EUR; Free of charge 1 year Internet Banking and 6 months SMS Banking service. | 100AZN - Note: No commission is charged where the minimum amount of the deposit into the account is 100,000 AZN/USD/EUR or a customer has at least 100,000 AZN/USD/EUR in his savings account. | 20 AZN - Notes: - No commission is charged where the minimum amount of the deposit into the account is 2000 AZN/USD/EUR; Free of charge 1 year Internet Banking and 6 months SMS Banking service. | 8AZN - Note: No commission is charged where the minimum amount of the deposit into the account is 1000 AZN/USD/EUR. | 7AZN | 8AZN - Note: No commission is charged where the minimum amount of the deposit into the account is 1000 AZN/USD/EUR. | 7AZN |

| 30 AZN - Note: Free of charge 2 years Internet Banking and 12 months SMS Banking service. | 300AZN | 30 AZN - Note: Free of charge 2 years Internet Banking and 12 months SMS Banking service | 14AZN | 12AZN | 14 AZN - | 12AZN |

| 40 AZN - Note: Free of charge 3 years Internet Banking and 18 months SMS Banking service. | 400AZN | 40 AZN - Note: Free of charge 3 years Internet Banking and 18 months SMS Banking service | 20AZN | 18AZN | 20AZN | 18AZN |

| AZN/USD/EUR | AZN/USD/EUR | Subject to type and validity term of the card, as per the schedule of fees on issue and maintenance of the card | AZN/USD/EUR | AZN/USD/EUR | AZN/USD/EUR | AZN/USD/EUR |

| - Medical and Legal Information Services – International Discounts Offers | Medical and Legal Information Services – International Discounts Offers – Advance hotel booking without fees and discounts - - Visa Luxury Hotel Program – 1 mln USD travel insurance from UK’s AXA insurance company – Concierge service – Golf club discounts - while Priority Pass is not formally supported, online registration provides discount of up to 15% to Visa İnfinite card holders. Note: As Visa İnternational does not extend its special program to Azerbaijan, services related to Visa İnfinite cards are available abroad only. | AZN/USD/EUR | ATM withdrawals, real and virtual shopping, Internet purchases, purchase of goods and services via telephone and mail; where the minimum amount of the deposit into the account is 1000 AZN/USD/EUR, customer is provided with a free of charge 1 years card. | Note: Unlike other cards, no overdraft facility is available | - | Note: Unlike other cards, no overdraft facility is available. |

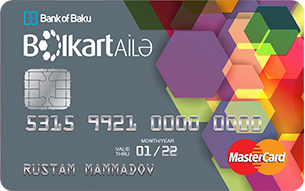

Mastercard Gold

For use of personal funds

| Minimum balance | Not applicable | |

| Card price |

|

Payment Card Security Precautions

Read moreMedical and legal services information line

International discounts offer

Free of charge SMS banking and Internet banking

Fee:

- Issue and 1 year service fee – AZN 20

- Issue and 2 years service fee – AZN 30

- Issue and 3 years service fee – AZN 40

If the minimum deposit to the account is 1000 AZN / USD / EUR, it is possible to get a 1-year MC Gold Card free of charge.

Təmassız ödəniş:

Təmassız ödəniş funksiyası dedikdə Pin kod daxil edilmədən kartla 100 manatdan çox olmayan məbləğlər həddində əməliyyatların həyata keçirilməsi nəzərdə tutulur.

Urgent order:

- AZN 15

Sum insured:

not provided

Change of card status:

- No fee

Card replacement:

- Subject to type and term of the card, fee applicable upon issue and service for the card

Issue of PIN duplicate:

- AZN 5

Card renewal (extension):

- Subject to type and term of the card, fee applicable upon issue and service for the card

Issue of an additional card:

- Subject to type and term of the card, fee applicable upon issue and service for the card

Card reactivation:

- AZN 2

“Chargeback” review:

- AZN 10

| Fees for cards usage | |

|---|---|

| Cash withdrawals at "Bank of Baku" ATMs and POS terminals | 1% (min. 1 AZN/USD/EUR) |

| Cash withdrawal through ATMs of local banks | 1.5% (min. 1.5 AZN/USD/EUR) |

| Cashing out through POS terminals of local banks | 1.5% (min. 2.5 AZN/USD/EUR) |

| Cash withdrawal through ATMs of foreign banks | 1.5% (min. 3.5 AZN/USD/EUR) |

| Cashing out through POS-terminals of foreign banks | 1.5% (min. 6 AZN/USD/EUR) |

| ATM vasitəsilə ŞEN-kodun dəyişdirilməsi | 1 AZN |

| ATM vasitəsilə ŞEN-kodun bərpa edilməsi | 2 AZN |

| “Card to Card” sistemi üzrə köçürmələr | 0.2% (min 0.25 AZN / 0.25 USD / 0.25 EUR) |

| “ATM Bankçılıq” sistemindən istifadə | No fee |

| "SMS Bankçılıq" sisteminə qoşulma və dəstəklənmə | 5 AZN |

| Conversion | Depending on the payment system of the card, transactions (ATM, Card to Card, online, retail, etc.) in any currency other than the card currency are converted in accordance with the exchange rate set by the international payment system Visa or Mastercard and non-cash purchase and sale rates of the bank. Note: Non-cash conversion operations are possible on payment cards issued by the Bank in the amount of not more than 200 (two) US dollars or euros per day. |

| Retail transactions | No fee |

| "Retail" transactions in gaming / entertainment centers, including casinos* | 1.5% (min. 2 AZN/USD/EUR)* |

* According to the Law on Amendments to the Code of Administrative Offenses of the Republic of Azerbaijan dated December 27, 2021, gambling operations are blocked. Note: Commission is not charged if funds are transferred to the card in cash at Bank of Baku branches or payment terminals owned by Bank of Baku OJSC. No commission is charged for 200 AZN deposits per day through MilliOn and E-manat payment terminals, website and mobile applications, if deposit amount is more than 200 AZN 0.5% commission (min. 1 AZN) is charged. Depositing funds to USD and EURO currency cards is possible only in the branches of Bank of Baku OJSC. | |

Select the type of card